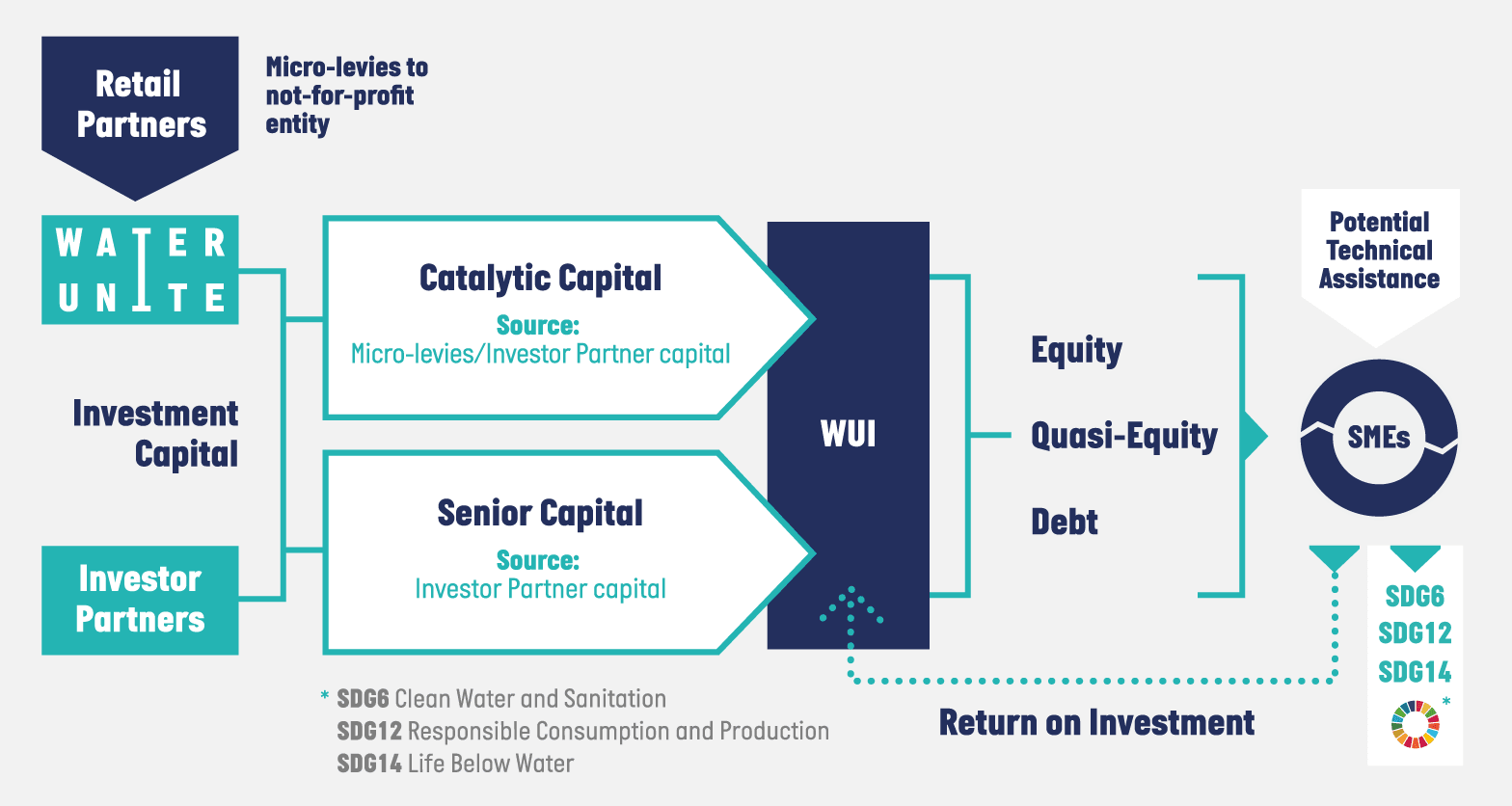

Water Unite has created Water Unite Impact (WUI), managed by FCA authorised impact investment manager Wellers Impact, to provide risk-tolerant capital to Small & Medium Enterprises (‘SMEs’) in the water, sanitation and plastics recycling sectors.

Retailer participation in Water Unite Impact will be catalytic for the water, sanitation and plastics recycling sector. Micro-contributions will have a significant leverage effect: attracting external expertise and commercial capital to achieve social impact, in a way that cannot be achieved with philanthropic capital.

Social Impact

Water Unite Impact will address the funding gap in parts of the finance landscape for the water, sanitation and plastics recycling sectors not met through charitable foundations, microfinance institutions, commercial banks and/or formal capital markets. Enhanced governance mechanisms will ensure that Water Unite Impact remains true to Water Unite’s social mission and only invests in projects which achieve both a financial return and a high level of social impact in its priority sectors.

Key areas of focus:

- Systems strengthening: Improve operational efficiency, transparency and coordination among water, sanitation and plastics recycling service providers, government and sources of finance.

- Circular economy: Encourage the use of materials to reduce pollution and ultimately limit greenhouse gas emissions and other by-products of industrial processes that are harmful to the environment.

- Sustainable revenue streams: Institutionalise full cost recovery models in water, sanitation and plastics recycling to reduce dependence on foreign aid and government subsidy.

- Commercial capital channelled to priority sectors: Crowd in commercial capital by demonstrating financial viability.

- Community resilience: Withstanding impact of airborne and waterborne pandemics.

Structure

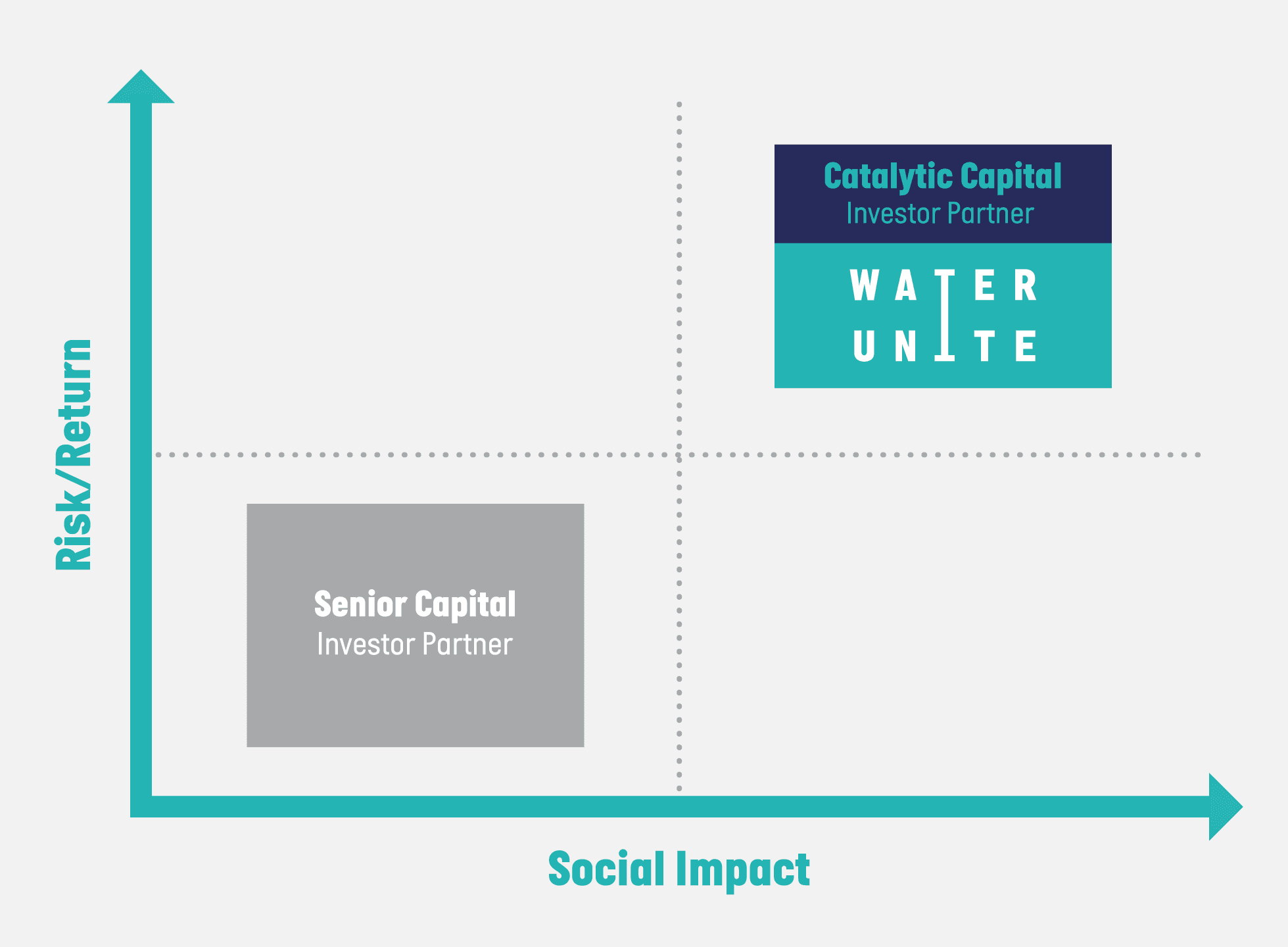

Water Unite Impact has a risk-reward structure, where the micro-levies and foundation money will act as catalytic capital to attract commercial investment. This is a dynamic way of enabling each dollar of funding to support more than one organisation and multiply social impact many times over.

Underlying Investments

- WUI invests in SMEs through debt, equity or quasi-equity, combined with technical assistance.

- WUI will further leverage against technical assistance provided by aid agencies and development finance institutions to these SMEs.

- Portfolio diversity will seek to minimise defaults and reduce impact of currency volatility.

- Investments provide catalytic funding, to encourage innovation and knowledge transfer and/or facilitate growth of these enterprises so that they can scale activities.

- Investments are guided by internal investment guidelines with a view to managing concentration risks as WUI grows.

Micro-levies as Credit Enhancer

Catalytic Capital which will act as a credit enhancement for the senior capital is essential due to the following:

- Impact acceleration: Attracts capital towards addressing challenges in the water, sanitation and plastics recycling sector that could not be mobilised otherwise, thus multiplying the scale of impact many-fold.

- Resource optimisation: Lay the groundwork for sustainable investment flows into markets previously untouched or underserved by formal capital markets. Incentivising commercial investors to explore new underserved markets.

- Better terms for SMEs: Foster healthy and responsible competition in local markets to enable fairer and more accessible terms for SMEs that are demonstrably working to address important social and/or environmental problems.

Investment involves risk. The value of investments, and the income from them, can go down as well as up and an investor may get back less than the amount invested. Past performance is not a guide to future results. Suitable for Professional, Sophisticated and High Net Worth Investors Only.

Wellers Impact Limited is a limited company regulated by the Financial Conduct Authority, and registered in England and Wales with Company Number 9857205. Their FCA Number is 767086.

65 Leadenhall Street, London, EC3A 2AD +44 (0) 20 7481 2422 info@wellersimpact.com

Water Unite is a registered charity in England and Wales (no. 1210716) and registered 501(c)(3) non-profit in the United States (EIN: 84-2485313). Registered company limited by guarantee (no. 10036997). 65 Leadenhall Street, London, EC3A 2AD, United Kingdom.