Water poverty, lack of adequate sanitation, and plastic pollution are three of the most pressing issues that the world faces today. The poorest nations bear the brunt of this devastating reality with hundreds dying every day as a result. While the United Nations’ Sustainable Development Goals (SDGs) aim to address the problem, there is a funding gap in the water, sanitation and plastics sectors which risks the fulfilment of these goals. Water Unite endeavours to fill this gap through an innovative financial model that combines philanthropic capital with private sector funding to ensure that these critical global issues are eradicated.

Scale of the problem

Nearly 800 million people do not have access to adequate water sources and 1 in 3 people across the world cannot access improved sanitation. As a result, more than 800 children die every day from diseases caused by the lack of clean water and adequate sanitation. On top of this, of the 300 million tonnes of plastic waste produced, only 15% is recycled. This has, and continues to cause, widespread pollutions of the natural environment, particularly the ocean. Aside from the ocean’s critical environmental importance, it is also a major food source and provider of livelihoods across the globe.

Scale of the mission

In 2015, the United Nations set out its 2030 Agenda for Sustainable Development, whereby they established 17 SDGs with 169 challenging targets. An unprecedented mobilisation of funding will be required to meet these goals. It is estimated that the achievement of all SDGs will have an annual cost of around US$2.4 trillion of public and private investment.[1] In 2016, the World Bank estimated that US$114 billion per year of capital investments will be required to provide universal access to safely managed water and sanitation services by 2030, which is approximately triple the current level of investment provided by countries.[2] These vast sums highlight the extensive effort required by both governments and the private sector to hit these targets.

A model for change

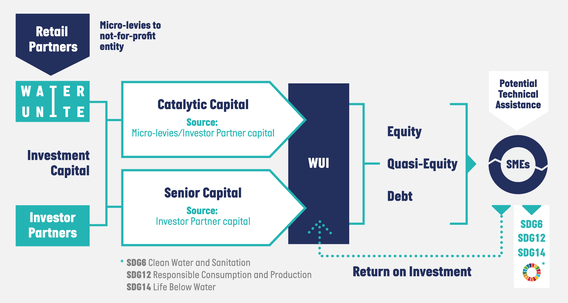

We are committed to finding a solution to this funding gap. We have launched Water Unite Impact, managed by Wellers Impact, to address the ‘missing middle’ - the funding gap in the water, sanitation and plastics recycling sectors that is not met through charitable foundations, microfinance institutions, commercial banks and/or formal capital markets.

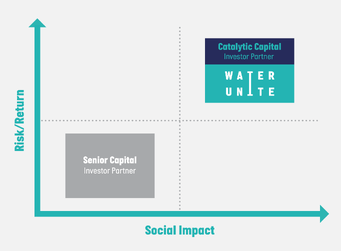

The fund’s innovative financial model will inject capital into the water, sanitation and plastics recycling private sectors. Water Unite’s micro-levy of 1 cent for every litre of bottled water purchased is the foundation of their fundraising approach. These funds will be used as catalytic capital to leverage additional private sector capital, offering a no-cost risk mitigant to borrowers with poor levels of creditworthiness that would otherwise be unable to access the favourable funding terms that would support their growth and ability to be responsive to the needs of some of the world’s most vulnerable populations. This strategy will demonstrate a creative way of enabling each dollar of funding to support more than one organisation, and to multiply social and environmental impact many times over.

Using an impact investing strategy, Water Unite Impact will target impact aligned with Sustainable Development Goal 6: Clean Water and Sanitation, Goal 12: Responsible Consumption and Production, and Goal 14: Preventing and Reducing Marine Pollution. Impact investing is investing with the deliberate intention of creating positive social or environmental change alongside a financial return. This kind of investing arguably has the greatest effect because of its active intent to generate impact.

What Water Unite Impact will be funding

The pilot will target small and medium-sized enterprises (SMEs) in the private sector who find themselves in the missing middle. These SMEs are all addressing local problems with innovative and sustainable solutions. There are three investment strategies within these sectors that Water Unite Impact is targeting.

• Innovative SMEs - Funding for SMEs who have already proven their ability to repay smaller obligations but are not yet ready to service larger loans from commercial or Development Finance Institution sources.

• Bridging finance - By bridging the funding gaps in performance and output-based contracts, the SMEs will receive short-term financing to enable them to achieve their output-based contract objectives.

• Public Private Partnerships – The fund will also offer risk-tolerant capital to private providers in Public Private Partnerships (PPP), especially those involved in projects that require decades to achieve success and social impact.

“Proving this pilot scheme opens up incredible possibilities to change the lives of millions of people throughout the world by funding innovative, entrepreneurial and sustainable water, sanitation and plastic private businesses and service providers.” - Wellers Impact

Looking ahead, Water Unite hope that the launch of the Water Unite Impact - and its ultimate success - will create a provable, systematic and sustainable investment approach to tackling water, sanitation and plastics recycling issues at scale and act as a catalytic and transformative model for the entire sector.

Wellers Impact is a FCA-regulated impact investment manager based in the UK. The team’s investment models are centred on using fair economics to pursue SDGs-aligned impact. Wellers Impact has three core business activities: real estate development in partnership with land-owning East African not-for-profits, provision of Sustainable Development Finance and Water Unite Impact. For more information on Wellers Impact, visit their website.

[1] http://s3.amazonaws.com/aws-bsdc/BSDC_SustainableFinanceSystem.pdf

[2] https://www.worldbank.org/en/news/press-release/2016/02/12/more-money-and-better-service-delivery-a-winning-combination-for-achieving-drinking-water-and-sanitation-targets